"For over six decades, "Broadway" has been the community banker."

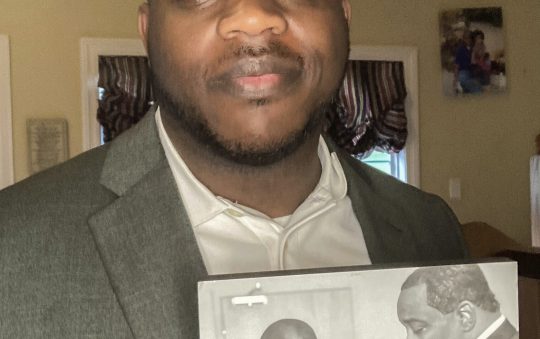

As the nation's economic condition worsens, it is fitting to note that a local of bank, dedicated to serving the community, has been the forefront working with the community, for the community and in the community for over sixty years. Broadway Federal Bank is synonymous with the name, Hudson: H. Claude Hudson, the patriarch; Elbert, his accomplished son and Paul, his grandson. Since its inception, a Hudson has always been at the helm of the bank, which is now a landmark institution in the Los Angeles community.

The mission of the bank is to serve the real estate, business and financial needs of customers in underserved urban communities with a commitment to excellent service, profitability and sustained growth. It also has a broader commitment to employ, train and mentor community residents, to contract for services with community businesses, and to encourage its management and staff to serve as volunteers in civic, community and religious organizations. In addition "Broadway" has enunciated a system of values that complements its mission and correspond with its Community Reinvestment Act (CRA) rating.

Beginning with Dr. H. Claude Hudson, a dentist who had graduated from at Howard University in 1913, he settled in Los Angeles in 1923 and continued his active involvement in the civil rights movement with the National Association for the Advancement of Colored People (NAACP); he had been previously involved with the organization, as president, in Shreveport, Louisiana. (His strong commitment to the civil rights struggle, according to reports, was borne out of an experience that he had witnessing the lynching of a Black man). He continued his dental practice and eventually became the president of the Los Angeles NAACP.

In 1929, along with renowned architect, Paul R. Williams (both their families became related), H. Claude built the Hudson-Liddell Building at 4166 South Central Avenue. He then enrolled in Loyola Law School and earned a law degree in 1931. Though he never practiced law in the traditional sense, H. Claude used his legal skills to advance his activities and agenda in civil rights and business. In furtherance of his quest to level the playing field for Blacks economically, joined together with a group of Black businessmen and founded Broadway Savings and Loan in 1946.

After receiving its federal charter and with an initial investment of $150,000, the bank welcomed its first customers in January 1947. It was housed in a three-room office on South Broadway, Los Angeles. Shortly afterwards, the leadership of the bank was taken over by H. Claude, one of the original investors. The focus of the bank was to satisfy the demand for homeownership in the Black community by the post World-War II veterans who were routinely denied mortgage loans by mainstream lending institutions. Having a "captive" market caused the bank to grow quickly and in 1954, it acquired the facilities of a closed department store and renovated it into the bank's headquarters. (Plans for the renovation were done by architect Williams, who was also one of its founding directors). H. Claude supervised the management as chairman of its board of directors for 23 years while maintaining his dental practice.

In 1966, "Broadway" opened another branch in the Midtown Shopping Center. Again, Williams designed the new facility. He remained chairman emeritus until his death in 1989 at the age of 102.

Enter Elbert T. Hudson, the son of H. Claude who, like his father, was an attorney who had also acquired a banking credential in 1964. When called upon in 1972, he was ready to take over the family business. He automatically moved into the position of president and chief executive officer (CEO) of the bank. In addition to banking, Elbert T. was also actively involved in the community. He was a member of the board of directors of the Brotherhood Crusade, and was instrumental in making it the premier charitable organization in the Black community during that period. And like his father, he was active in the NAACP.

During Elbert T.'s tenure at the helm, "Broadway" opened a third branch in Inglewood settling at a one story building in the heart of the city's downtown. He continued to fulfill the bank's mission and to provide training for minorities entering the financial industry. In 1992, tragedy struck around the time of his retirement. During the 1992 civil unrest, fire destroyed the bank's headquarters. However, it was only a temporary setback. Still wedded to the community, the bank established a temporary facility across from its destroyed building and continued its operation until a new facility was built years later not too far from the burnt site.

Then came Paul C. Hudson, Elbert T.'s son and H. Claude's grandson. Also an attorney, he followed the footsteps of both the elder Hudsons. Upon the retirement his father as CEO, Paul C. took the reins and moved the institution to a higher level. Elbert T. retired as chairman in 2006 and the board elected Paul C. as chairman; his father remains as chairman emeritus.

(Though called a bank, the actual name of the institution was Broadway Federal Savings and Loan until 1995, when it became Broadway Federal Bank. It was converted from a mutual savings and loan to a stock saving bank via a parent holding company, Broadway Financial Corporation. The holding company is a publicly traded stock company traded on the NASDAQ exchange).

As a publicly traded entity, "Broadway" in conjunction with new technology in banking, has aggressively implemented new branches, services and products to its existing portfolio. Within the past decade, its management has moved into new headquarters with full banking services on Wilshire Boulevard one of the "Wall Street" corridor of business in Los Angeles. And it has recently opened another service center on Crenshaw Boulevard, in the Leimert Park area, a Black cultural Mecca.

Presently the bank manages over 13,000 accounts with assets exceeding $225 million. The most of "Broadway's" loans are on local real estate with a strong emphasis on residential properties. In the commercial arena, the majority of its loan portfolio contains loans to churches within the community.

From a three-room office to its current five branches, "Broadway" has imprinted indelible footprints within the community. According to the information in its calendar, Broadway Federal (Bank) is dedicated to changing the paradigm and making our youth examine all possibilities in life, to challenge the youth to change their assumptions of what they can be, and look at careers from a different perspective. And finally, to the minority men and women whose ingenuity broke through the ceiling and helped open doors (so that others may walk through).