With COVID-19 putting a financial strain on American families and businesses, millions of us are counting on our government stimulus payments.

Eligible consumers will receive up to $1,200 while married couples will get up to $2,400, and $500 will be added for every child. The government estimates that more than 80 percent of Americans will receive a stimulus payment during these challenging times.

For many taxpayers, the stimulus payments will be deposited directly into their bank account.

But millions of consumers – including many of you reading this — will receive a paper check in the mail. That could be because you received a federal tax refund either last year or earlier this year by paper check rather than direct deposit. Check recipients more often may be senior citizens, lower-income and/or African Americans.

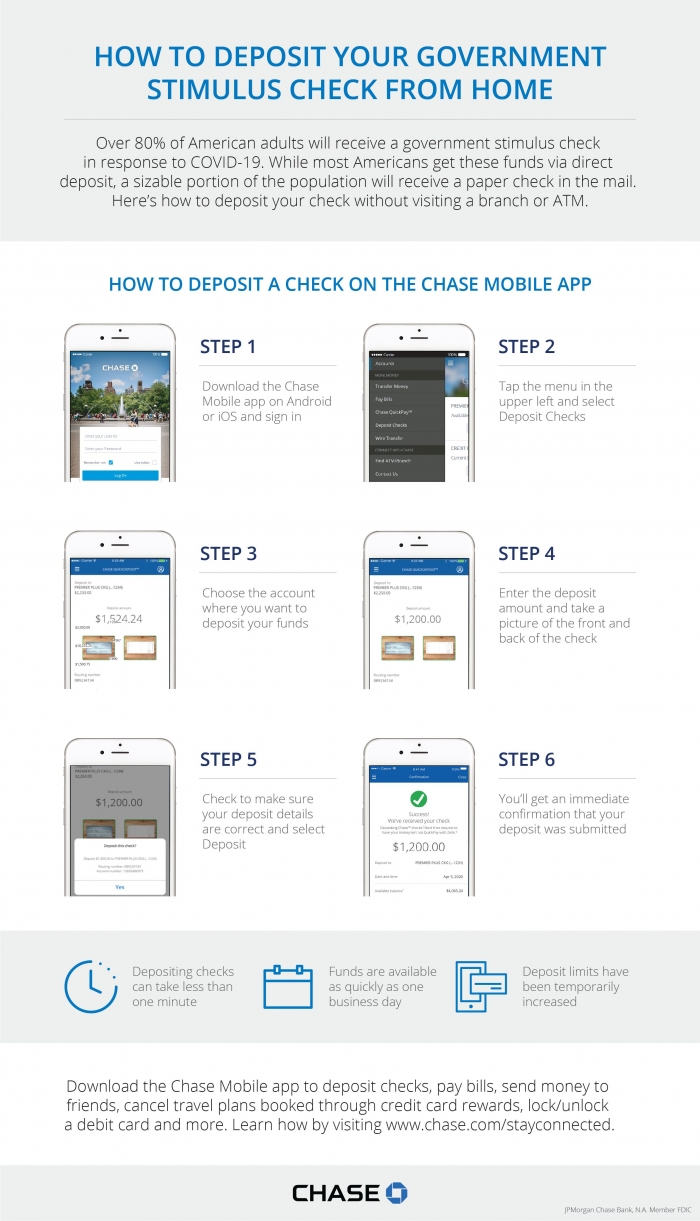

If you receive a paper check, my message to you is simple: Deposit your check using your bank’s mobile app from your smart phone or tablet instead of coming into your local bank branch. That keeps you safe and helps you comply with California’s stay-at-home order. It’s also very convenient.

In fact, you can do much of your banking by using your bank’s mobile app or going to its website.

So here’s what you need to know about banking digitally:

- You can use your bank’s mobile app or website to handle most common banking tasks like depositing checks, paying bills, sending money to friends, and locking and unlocking a credit or debit card.

- Chase customers can go to chase.com/stayconnected to enroll in digital banking, learn how to download the Chase Mobile app and watch how-to videos that walk you through it.

- If you have accounts at another bank, check out their website for their digital and mobile capabilities.

Skip the Trip

- Once you’re signed up for digital banking, depositing a check can take less than one minute, whether that’s a stimulus check, work payment or a check from a relative.

- For information about stimulus payments, visit the irs.gov or chase.com/stimulus for more information.

Banking made accessible

- Chase’s mobile banking app, for example, is available to all its customers, including those new to banking with a Secure Bank account. The account provides all the benefits of banking with Chase for a low monthly fee and with guardrails so you don’t spend more than what’s available.

- If you don’t have a bank account today with Chase or another bank, or are thinking about getting an account, check in with BankOn for affordable options. That would let you manage your money digitally, including paying bills, people, and depositing checks from your phone.

At Chase, we’re working hard to give you up-to-date information on how to prepare for these payments and for these challenging times. You can find the latest tools, tips and information at www.chase.com/stayconnected.

Please stay safe and take good care of yourself and your loved ones. We’re here to help you map your way during this uncertain time and beyond.