From the Assessor’s Office

There’s a deadline fast approaching that oftentimes is overlooked but is significant nevertheless — the Business Property Statements. And the deadline is here.

Each year Business Property Statements, which provide a basis for determining property tax assessments for business equipment and related fixtures, are mailed by my office to most commercial, industrial and professional firms.

Businesses with personal property with an aggregate cost of $100,000 or more must file a Business Property Statement each year by April 1. This is required by state law. However, you have until May 7 to file. After that a 10% penalty will be applied. Business inventory is exempt from taxation.

Generally, businesses with total personal property that cost less than $100,000 are not required to file a Business Property Statement annually. Instead, a value may be established based on an initial Business Property Statement filing or by an on-site appraisal. That value may be adjusted by subsequent annual on-site appraisals. Please note that if my office mails you a form, you are required by law to return the form regardless of the amount of personal property.

Business Personal Property is typically all property owned or leased by a business except Real Property and Inventory items.

Business Personal Property includes, but is not limited to:

Machinery

Computers

Office Equipment (e.g. FAX machines, photocopiers)

Telephones

Furniture (e.g. desks, chairs, bookcases)

Supplies

It’s important to remember that Business Personal Property is valued annually as of January 1. If you were in business or owned personal property on that day and have the required amount of property, you are required to file, even if the Assessor does not mail one to you. Business Property Statements are private documents and are held confidential by my office.

Having said that, I understand this has been a very difficult year for many businesses and I am inviting you to provide me with information about your business equipment for the possibility of some relief. The COVID-19 pandemic restrictions have had a negative impact on the value of many business assets, such as gyms, hotels and movie theaters, while others not so much. Businesses that were operating on Jan. 1 but then regrettably had to shutter are going to be considered. Make no mistake about this, I intend to be proactive about these reductions. As an example, our office proactively reduced Business Personal Property for about 47,000 businesses countywide last year.

Property taxes are based on the assessed value of your property. I also think it’s important to note that the very reason for our property taxes is to support vital public services provided to all of us, including law enforcement, fire protection, education, parks and recreation, as well as roads.

Property tax bills show land and improvement values. Improvements include all assessable buildings and structures on the land. In general, properties that are owned and used by educational, charitable, religious or government organizations may be exempt from certain property taxes. You may also qualify for certain exemptions.

The bureaucratic name for the Business Personal Property form is the 571-L and as I mentioned it must be filed no later than May 7 to avoid a penalty. However, May 7 falls on a weekend this year so the deadline is actually May 9. To file the form online or just to learn more about this go to https://assessor.lacounty.gov/businessowners/business-prop-statement-filing.

Finally, if you want to contact us by phone, please call (213) 974-3211 or (888) 807-2111 toll-free.

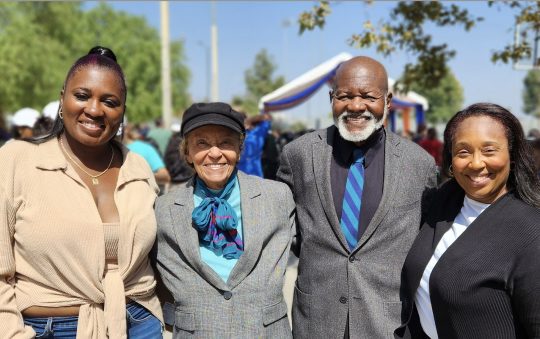

Los Angeles County Assessor Jeff Prang has been in office since 2014. Upon taking office, Prang implemented sweeping reforms to ensure that the strictest ethical guidelines rooted in fairness, accuracy and integrity would be adhered to in his office, which is the largest office of its kind in the nation with 1,400 employees and provides the foundation for a property tax system that generates $17 billion annually.